Jul 9, 2025, 08:51 GMT+2 A look at the European and global markets session by Kevin Buckland Donald Trump may have disrupted metals trading overnight with the threat of 50% tariffs on copper imports, but the overall market reaction to an ever-evolving scenario appears relatively calm and cautious, certainly not as chaotic as after the 'Liberation Day' at the beginning of April. With the deadline for the implementation of trade tariffs moved to August 1, the markets have another three weeks to better prepare for the measures. Some observers also believe that the new date could be flexible. Judging by the latest words from the US president "there will be no more extensions"; however, it should be remembered that Trump himself previously described August 1 as "firm, but not 100%." In any case, the White House tenant continues to say he is open to offers.

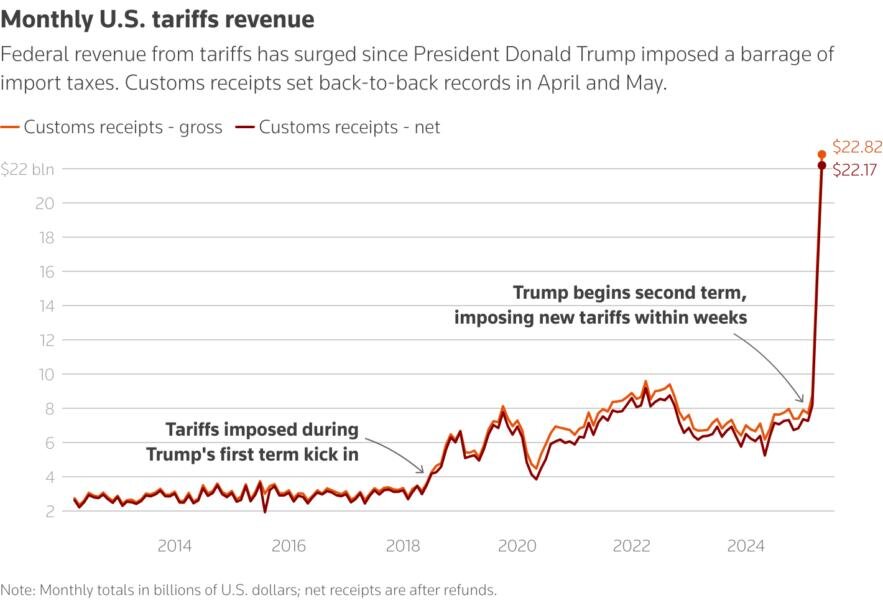

Thomson ReutersMonthly U.S. tariffs revenue

European equity derivatives contracts are pointing slightly higher, in contrast to signs of continued - albeit slight - weakness on Wall Street. Asian stock markets are mixed, reflecting endogenous factors. The weakness of the yen limits losses on the Nikkei NI225 and political hopes lift the South Korean index, while the Australian stock market continues to feel the effects of the central bank's decision yesterday not to cut rates.

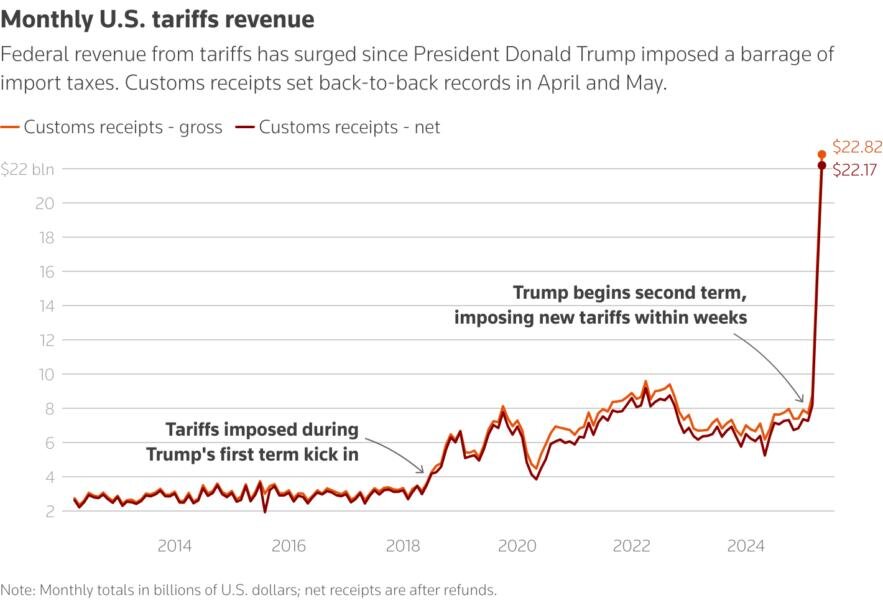

Thomson ReutersMonthly U.S. tariffs revenue

Asian stock markets are mixed, reflecting endogenous factors. The weakness of the yen limits losses on the Nikkei and political hopes lift the South Korean index, while the Australian stock market XJO continues to feel the effects of the central bank's decision yesterday not to cut rates. Two opposing forces are at play on copper: US futures rose to all-time highs overnight, but those in London and Shanghai are falling, given the limited time window to ship the red metal to the US before the new tariffs come into effect. Trump is also threatening a 200% tax on pharmaceuticals, but promises a year or more for pharmaceutical companies to prepare. Among the few assets currently showing a clear direction is the dollar, which is trading at multi-week highs against the yen and regaining ground against major currency counterparts. The sparse agenda of macro or corporate events in Europe keeps the focus on trade negotiations between Washington and Brussels. Although the US and EU are close to a sort of framework agreement, Trump speaks of an upcoming letter to the EU on tariffs. Events that could influence the markets: - Speeches by ECB Vice President Luis de Guindos and Chief Economist Philip Lane - Federal Reserve publishes minutes of June monetary policy meeting

VOICE SUMMARY LINK: https://t.me/seriamentetrading/2757